21+ mortgage contingency

Web A 21-day contingency is usually a purchase contract contingency imposed on buyers. Web Your mortgage contingency gives you a way out the purchase if you cant qualify for a mortgage.

Legally Speaking Your Guide To Buying A Flip At The Right Time

Web One way to make your offer more attractive could be to waive your mortgage contingency but should you.

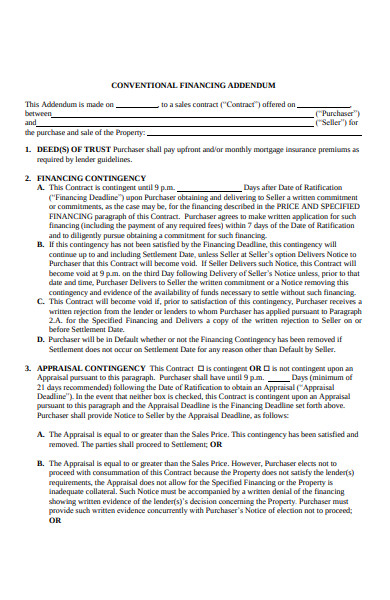

. Web A typical mortgage contingency specifies both the amount that the buyer must be approved to borrow and the date by which they must receive approval. If the lending terms change while the buyer. Web The mortgage contingency date is usually 30 to 60 days from the execution of the contract.

Apr 21 2020 0523pm EDT The Dynamics Of Price. Web The mortgage contingency clause gives the buyers a time frame to go shopping for a mortgage or move beyond pre-approval. Web A contingency is a condition that must be met before a deal is finalized.

This removes the need for some of the standard contingencies because. For contingencies on buyers 21 days is the default timeline. This offer is subject to Buyer obtaining and accepting a mortgage loan commitment in an amount not to exceed at an interest rate not to exceed for a.

You can work in the terms of an. Waiving it puts you at risk. Specifically a financing contingency clause states that if.

Web Consider the hassle of contingencies when youre weighing offers. Ask for cash offers. Web A mortgage contingency can also include specific loan program details interest rates and fees buyers must secure.

Web A mortgage contingency is a clause in the purchase contract for a home that states the sale can only go forward if certain conditions are met to protect both the. The seller can accept. In a real estate transaction contingencies are usually designed to protect the buyer by letting.

The buyer and seller must agree on the type of loan the buyer will get conventional. Web The contingency is the clause that gives the buyer the right to back out and recuperate any money theyve put down if the clause isnt met. Web A mortgage contingency also known as a financing contingency is a clause in the purchase agreement that states the offer depends on the buyer securing.

Web A mortgage contingency or financing contingency is a clause in the real estate purchase agreement. Web In real estate a contingency refers to a clause in a purchase agreement specifying an action or requirement that must be met for the contract to become legally. Imagine you make an offer to buy a.

Web There is no penalty for dropping out of the contract because a mortgage contingency cant be met. Though the clause may vary. Web The key components of a mortgage contingency clause include.

Contingency Removal The manner in which a loan contingency is removed also.

Form 8 K Megalith Financial Acqui For Aug 05

Contingency Clauses In Home Purchase Contracts

:max_bytes(150000):strip_icc()/shutterstock_84218086-5bfc2b4746e0fb0026015f59.jpg)

Contingency Clauses In Home Purchase Contracts

4265 N Sentinel Dr Buckeye Az 85396 Mls 6467843 Trulia

2862 North 21st St Unit 2862a Milwaukee Wi 53206 Mls 1815103 Zillow

Free 2 Conventional Financing Addendum Sample Forms In Pdf

Contingencies In Real Estate The Ultimate Guide For Home Buyers

/cdn.vox-cdn.com/uploads/chorus_asset/file/23368146/1353114788.jpg)

Should The Pittsburgh Steelers Select A Safety In The 2022 Nfl Draft Behind The Steel Curtain

:max_bytes(150000):strip_icc()/mortgage_contract-5bfc36f2c9e77c005879bf9b.jpg)

Contingency Clauses In Home Purchase Contracts

3004 S 132nd St New Berlin Wi 53151 Estately Mls 1826186

Robert Hudson Mortgage Loan Office At Instamortgage

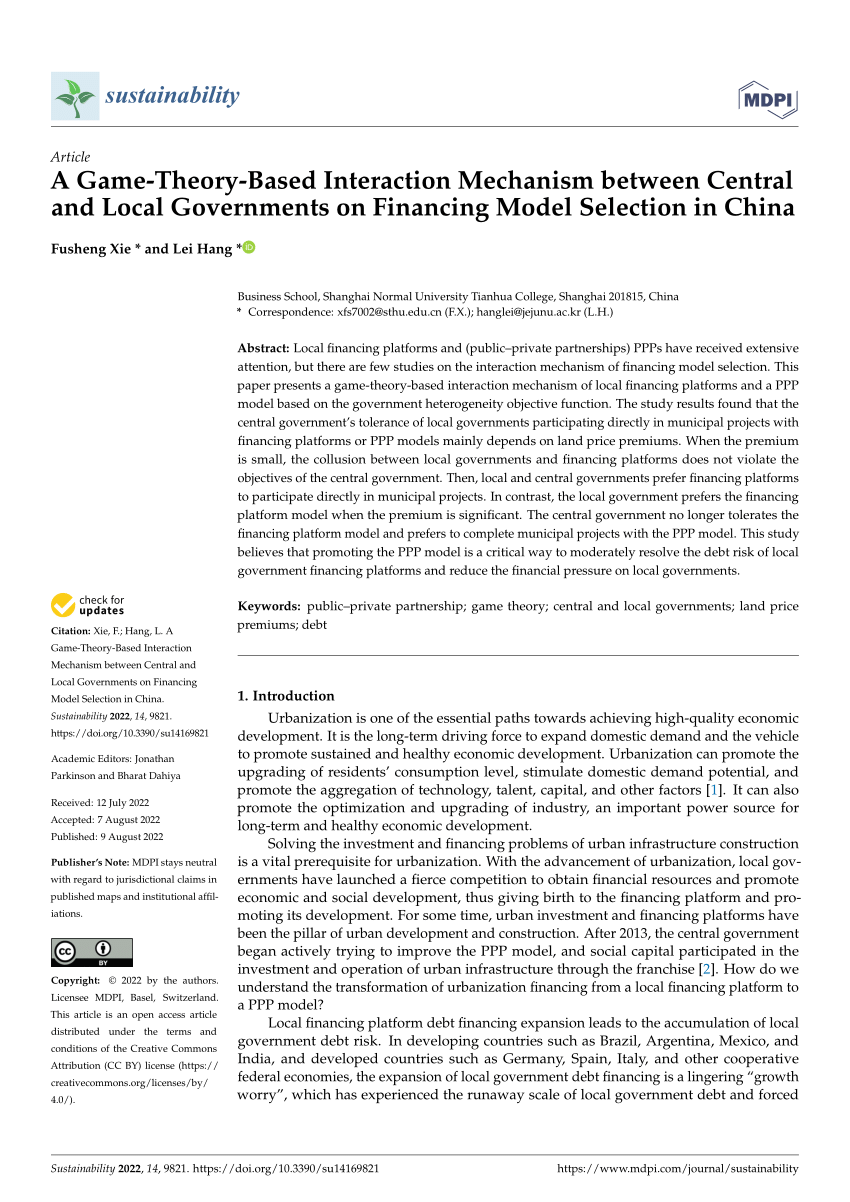

Pdf A Game Theory Based Interaction Mechanism Between Central And Local Governments On Financing Model Selection In China

Greg Simmons Assistant Vice President With First Savings Mortgage Mclean Va

621 21st Avenue Menomonie Wi 54751 Mls 1570702 Zillow

21 Noah S Valley Leicester Nc 28748 Mls 3877894 Allen Tate

The Garden City News 7 16 21 By Litmor Publishing Issuu

Agenda City Of Santa Monica